Contract Lifecycle Management Software Market Scope and Overview

The Contract Lifecycle Management Software Market has become an essential part of modern business operations, enabling organizations to streamline contract processes, ensure compliance, and reduce risks. CLM software manages the entire lifecycle of a contract, from initial creation and negotiation to execution, compliance, and renewal. As organizations increasingly recognize the need for efficient contract management, the demand for CLM solutions continues to grow across industries, from finance and healthcare to retail and government. This article provides an in-depth analysis of the Contract Lifecycle Management Software Market, covering competitive analysis, market segmentation, strengths, key points covered in the market research report, and concluding insights.

The Contract Lifecycle Management (CLM) Software market focuses on tools that streamline the management of contracts throughout their lifecycle—from drafting and negotiation to approval, compliance, and renewal. CLM software reduces the risks associated with contract mismanagement, such as missed deadlines or compliance violations, by automating workflows and providing greater visibility into contract processes. This market is expanding as companies seek to improve operational efficiency, reduce legal risks, and ensure compliance, particularly in highly regulated industries such as finance, healthcare, and pharmaceuticals.

Competitive Analysis

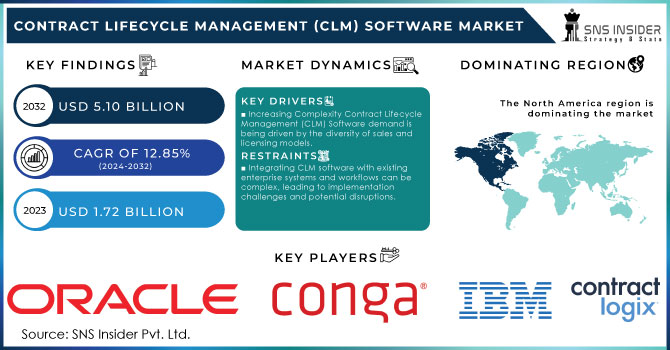

The Contract Lifecycle Management Software Market is highly competitive, with several key players offering comprehensive solutions to meet the growing needs of organizations. Some of the major players in the market include Conga, Contract Logix LLC, Coupa Software Inc, Icertis, Oracle Corporation, SAP SE, IBM Corporation, Determine Inc, DocuSign Inc, GEP Worldwide, Corridor Company, and others.

Icertis and Conga are recognized as leaders in the CLM market, known for their advanced contract management platforms that cater to large enterprises and multinational corporations. Icertis, for instance, offers an AI-powered CLM solution that provides deep insights into contract performance and compliance, helping organizations reduce risks and optimize contract outcomes. Conga focuses on providing a unified platform that integrates contract management with broader document and data management solutions, making it a popular choice for organizations looking to streamline their contract processes.

Oracle Corporation and SAP SE are also dominant players in the CLM market, offering enterprise-grade solutions that integrate seamlessly with their existing enterprise resource planning (ERP) systems. These solutions provide organizations with a holistic view of contract management, enabling them to automate workflows, ensure compliance, and improve collaboration across departments. IBM and DocuSign Inc are well-known for their digital transformation solutions, with DocuSign specializing in electronic signatures and contract automation, helping organizations accelerate the contract execution process.

Smaller players such as Contract Logix LLC, Determine Inc, and Corridor Company have carved out niches in the market by focusing on specific industries or functionalities, such as compliance management, contract analytics, or contract collaboration tools. As the CLM market continues to evolve, competition will likely intensify, with companies increasingly focusing on AI integration, cloud-based solutions, and advanced analytics to differentiate themselves.

Contract Lifecycle Management Software Market Segmentation

The Contract Lifecycle Management Software Market is segmented based on several criteria, including component, organization size, deployment type, and end-use industry. Each segmentation point highlights how CLM solutions are tailored to meet the unique needs of different organizations.

On the Basis of Component

- Software: The software component of CLM includes the platforms and tools that manage the entire lifecycle of a contract. These solutions provide features such as contract creation, collaboration, negotiation, approval workflows, and document storage. Major players like Conga, Icertis, and SAP offer comprehensive CLM software that integrates with existing business systems, ensuring seamless contract management and compliance.

- Services: In addition to the software, CLM vendors also offer various services, such as implementation, training, consulting, and support. These services help organizations customize their CLM solutions to meet specific business needs, ensuring successful deployment and user adoption. Companies like Coupa Software Inc and GEP Worldwide provide value-added services that complement their CLM software offerings, helping businesses maximize the return on investment (ROI) from their contract management solutions.

By Organization Size

- Small and Medium Enterprises (SMEs): SMEs often seek CLM solutions that are affordable, easy to implement, and scalable as the business grows. Cloud-based CLM solutions are particularly attractive to SMEs due to their lower upfront costs and flexibility. Companies like DocuSign and Contract Logix LLC offer CLM platforms tailored to the needs of SMEs, with features like automated contract workflows, document storage, and electronic signatures.

- Large Enterprises: Large enterprises require more robust CLM solutions that can handle complex contract management needs, such as multi-department collaboration, global compliance, and advanced analytics. These organizations often opt for enterprise-grade CLM platforms from vendors like Oracle, SAP, and IBM, which provide AI-powered contract analytics, compliance tracking, and integration with other business systems like ERP and customer relationship management (CRM) software.

On the Basis of Deployment Type

- On-premises: On-premises CLM solutions are deployed on a company’s internal servers and infrastructure, offering greater control over data security, customization, and compliance. These solutions are typically preferred by large organizations with stringent regulatory requirements or specific data privacy concerns, such as financial institutions and government agencies. On-premises CLM platforms from vendors like Oracle and SAP provide advanced security features, ensuring that sensitive contract data is protected.

- Cloud: Cloud-based CLM solutions are hosted on cloud platforms, offering businesses greater flexibility, scalability, and cost-effectiveness compared to traditional on-premises solutions. Cloud CLM allows organizations to access contract data from anywhere, making it an attractive option for companies with remote teams or multiple locations. Leading players like Icertis, Conga, and DocuSign offer cloud-based CLM solutions that provide real-time contract visibility, automated workflows, and advanced analytics.

On the Basis of End-Use

- Government: Government agencies use CLM solutions to manage contracts related to public procurement, compliance, and regulatory requirements. CLM software helps government bodies ensure transparency, track contract performance, and manage risks associated with complex contracts. Vendors like IBM and SAP offer CLM solutions that are tailored to the specific needs of the public sector, providing features such as audit trails, compliance tracking, and reporting.

- Retail and eCommerce: In the retail and eCommerce industry, CLM software is used to manage supplier contracts, vendor agreements, and customer contracts. These solutions help retailers streamline contract negotiations, improve supplier collaboration, and ensure compliance with procurement policies. Retail companies often opt for cloud-based CLM solutions that can be easily integrated with their procurement and supply chain management systems, helping them manage contracts efficiently.

- Healthcare and Life Sciences: The healthcare and life sciences sector faces stringent regulatory requirements when it comes to contract management, particularly in areas such as patient data privacy, clinical trials, and vendor compliance. CLM software helps healthcare organizations manage contracts with vendors, suppliers, and research partners while ensuring compliance with regulations like HIPAA and GDPR. Companies like Conga and Icertis offer CLM solutions that are tailored to the specific needs of the healthcare industry, providing features like compliance tracking, risk management, and contract analytics.

- BFSI (Banking, Financial Services, and Insurance): In the BFSI sector, CLM software is used to manage contracts related to loans, insurance policies, vendor agreements, and compliance requirements. These solutions help financial institutions reduce risks, ensure regulatory compliance, and improve contract visibility across departments. Vendors like Oracle, SAP, and IBM provide enterprise-grade CLM platforms that offer AI-powered contract analytics, compliance tracking, and integration with existing financial systems.

- Others: Other industries, such as manufacturing, telecommunications, and legal services, also benefit from CLM software. These solutions help organizations manage contracts with suppliers, partners, and customers, ensuring that contracts are executed efficiently and risks are minimized. CLM vendors often provide industry-specific features and compliance tools to meet the unique needs of these sectors.

Strengths of the Contract Lifecycle Management Software Market

The Contract Lifecycle Management Software Market has several strengths that make it an integral part of modern business operations:

- CLM software automates many of the manual processes involved in contract management, such as contract creation, approvals, and renewals. This automation leads to significant time savings, reduced administrative costs, and fewer errors, enabling organizations to manage contracts more efficiently.

- CLM solutions help organizations mitigate risks by providing tools to ensure compliance with legal and regulatory requirements. These solutions track key contract terms, monitor contract performance, and provide alerts for contract renewals or potential breaches, helping businesses avoid costly penalties or disputes.

- CLM platforms facilitate collaboration between different departments, such as legal, procurement, and finance, by providing a centralized repository for all contract-related documents and information. This improves communication, reduces bottlenecks, and ensures that all stakeholders have access to up-to-date contract data.

- Advanced CLM solutions offer AI-powered contract analytics, which provide organizations with valuable insights into contract performance, risks, and opportunities. These insights enable businesses to make more informed decisions, optimize contract terms, and improve overall contract management outcomes.

Key Points Covered in the Market Research Report

A comprehensive market research report on the Contract Lifecycle Management Software Market addresses several key points:

- The report provides insights into the current size of the CLM software market and its projected growth over the next five years. Factors driving growth, such as increasing demand for automation and cloud-based solutions, are also analyzed.

- The report offers an in-depth analysis of the major players in the CLM software market, including their market share, product offerings, strategic initiatives, and recent developments. Understanding the competitive landscape helps businesses identify the top vendors and the innovations that differentiate them.

- The market research report explores the latest technological advancements in the CLM market, such as the integration of artificial intelligence (AI), machine learning (ML), and blockchain technologies. These technologies are revolutionizing contract management by providing predictive analytics, automating negotiations, and enhancing contract security.

- The report identifies the primary challenges organizations face in implementing CLM software, such as resistance to change, data security concerns, and integration with legacy systems. It also provides potential solutions to overcome these challenges, including best practices for implementation and employee training.

- The report breaks down the CLM software market by region, highlighting the growth opportunities and challenges in North America, Europe, Asia-Pacific, and other regions. Understanding regional differences is crucial for businesses looking to expand globally or tailor their CLM strategies to specific markets.

- The report provides detailed insights into how different industries, such as government, retail, healthcare, and BFSI, are using CLM software. It examines the specific needs and challenges of each industry and how CLM solutions are helping them improve contract management and compliance.

Conclusion

The Contract Lifecycle Management Software Market is experiencing significant growth as organizations across various industries recognize the need for efficient, automated contract management solutions. Key players such as Icertis, Conga, Oracle, SAP, IBM, and others are driving innovation in the market, offering advanced platforms that integrate AI, cloud, and analytics to streamline contract processes and reduce risks.

Market segmentation based on component, organization size, deployment type, and end-use highlights the versatility of CLM solutions in catering to different business needs. Small and medium enterprises (SMEs) are increasingly adopting cloud-based CLM solutions due to their affordability and ease of use, while large enterprises require more robust, on-premises platforms to manage complex contracts and ensure compliance.

The strengths of the CLM software market lie in its ability to automate contract processes, improve collaboration, enhance compliance, and provide data-driven insights. As organizations continue to face regulatory pressures and the need for efficient contract management, the demand for CLM solutions will only increase. The integration of emerging technologies like AI and blockchain will further drive the evolution of the CLM market, providing organizations with even more powerful tools to manage their contracts and mitigate risks.

In conclusion, businesses that invest in modern CLM software are better positioned to navigate the complexities of today’s contract management landscape. With the right CLM solution, organizations can streamline contract processes, reduce administrative costs, ensure compliance, and gain valuable insights that drive better decision-making and long-term success. The future of the CLM software market is promising, with continued innovation and adoption expected to fuel growth in the coming years.

Table of Contents

- Introduction

- Industry Flowchart

- Research Methodology

- Market Dynamics

- Impact Analysis

- Impact of Ukraine-Russia war

- Impact of Economic Slowdown on Major Economies

- Value Chain Analysis

- Porter’s 5 Forces Model

- PEST Analysis

- Contract Lifecycle Management (CLM) Software Market Segmentation, by Component

- Contract Lifecycle Management (CLM) Software Market Segmentation, by Organization Size

- Contract Lifecycle Management (CLM) Software Market Segmentation, by Deployment Type

- Contract Lifecycle Management (CLM) Software Market Segmentation, by End-Use

- Regional Analysis

- Company Profile

- Competitive Landscape

- USE Cases and Best Practices

- Conclusion

Contact Us:

Akash Anand – Head of Business Development & Strategy

info@snsinsider.com

Phone: +1-415-230-0044 (US) | +91-7798602273 (IND)

About Us

SNS Insider is one of the leading market research and consulting agencies that dominates the market research industry globally. Our company’s aim is to give clients the knowledge they require in order to function in changing circumstances. In order to give you current, accurate market data, consumer insights, and opinions so that you can make decisions with confidence, we employ a variety of techniques, including surveys, video talks, and focus groups around the world.

Read Our Other Reports:

Insurance Telematics Market Share

Intelligent Document Processing Market Report

Intelligent Process Automation Market Forecast

Customer Success Platform Market Report

The post Contract Lifecycle Management Software Market Report Shows Promising Growth Opportunities appeared first on New York Business Post.